Empowering Street Vendors and Hustlers

Have you ever stopped by a Jerk Chicken Man but had no cash? Took out your wallet to pay the barber, then realised you only had cards? If this or any similar example sounds like you, I have good news! Handy Pay allows anyone to accept payments via the mobile app.

‘Card Machine Down’ has become a line we hear all too often. To truly increase digital payment adoption, we need an easy way for everyone to accept payments, and that’s why more people need to use Handy Pay.

This article covers how to accept payments with HandyPay, along with an insightful interview from the founder.

Accepting Payments

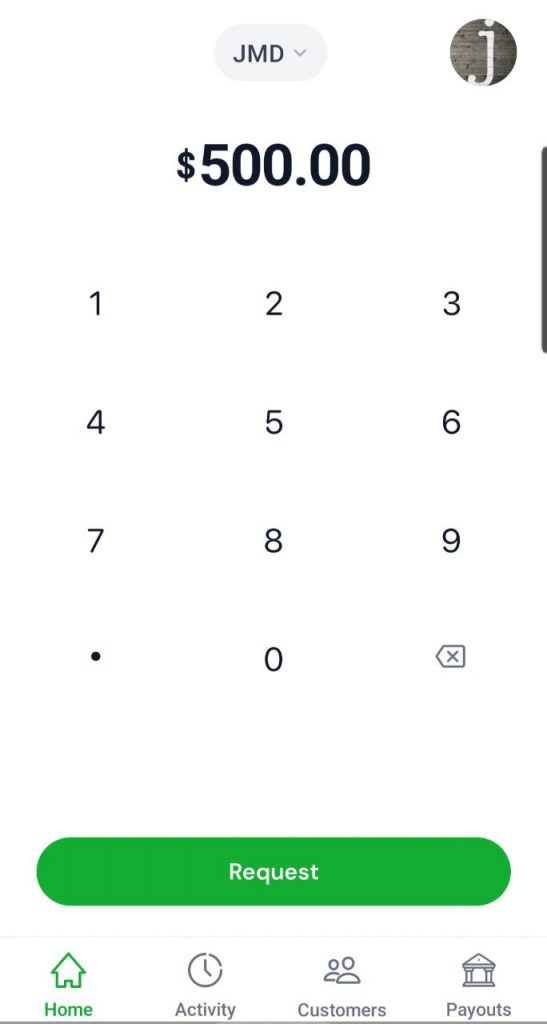

The sign-up process took me less than 8 minutes! Once completed, you can immediately start accepting payments. Your first payout has a 5 business day delay. This is to facilitate Stripe’s verification of your account. Once done, it usually takes about 2-3 business days for the payment to arrive in your local account. You can accept a payment in less than 5 steps

Step 1: Enter the Amount and tap request.

ADVERTISEMENT

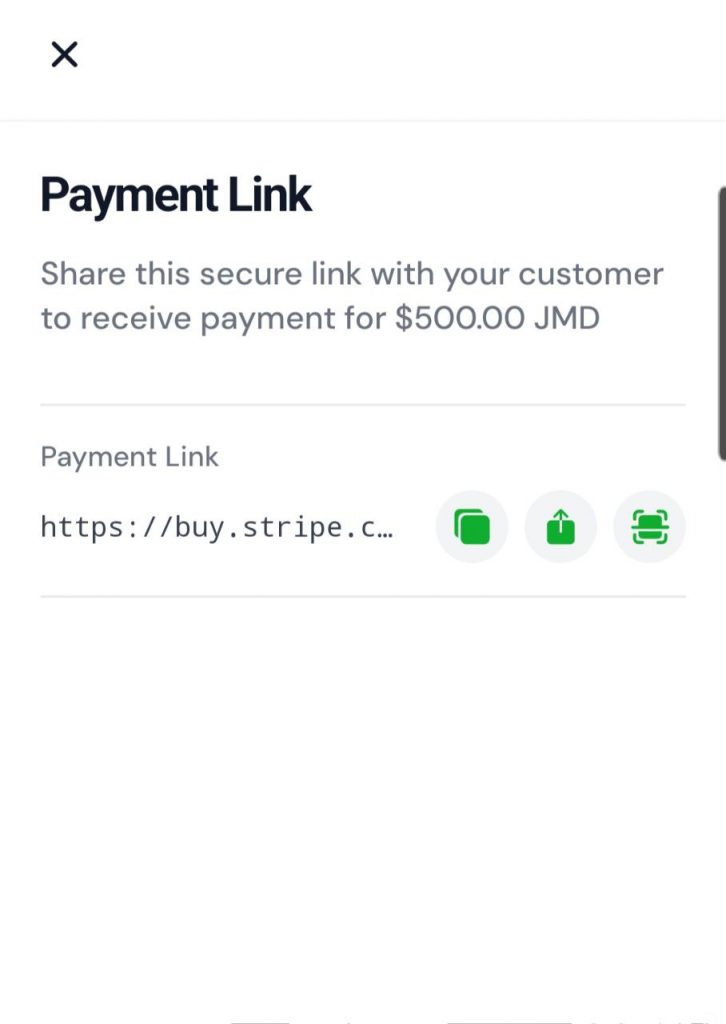

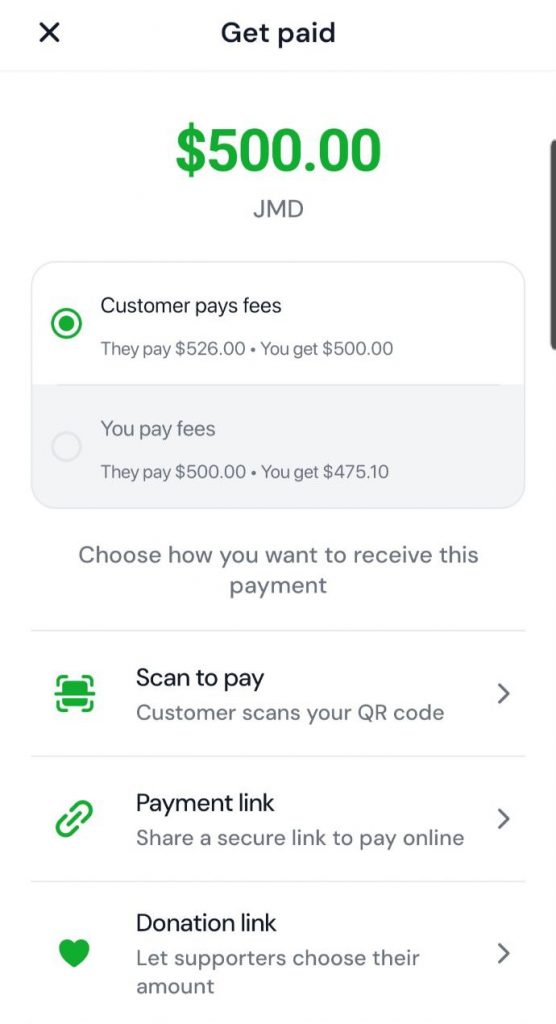

Step 2: Choose how you want to receive payment. HandyPay charges about 5% per transaction. As the merchant, you can absorb the fee or have your customer pay the fee. I will be selecting ‘Payment link’ for this tutorial.

Step 3: After selecting Payment link, you will be asked to authenticate the payment request. If your phone has a fingerprint scanner, you will be prompted for your fingerprint.

For the first request, the app will ask for location access. You can copy the link, share it, or turn it into a QR Code.

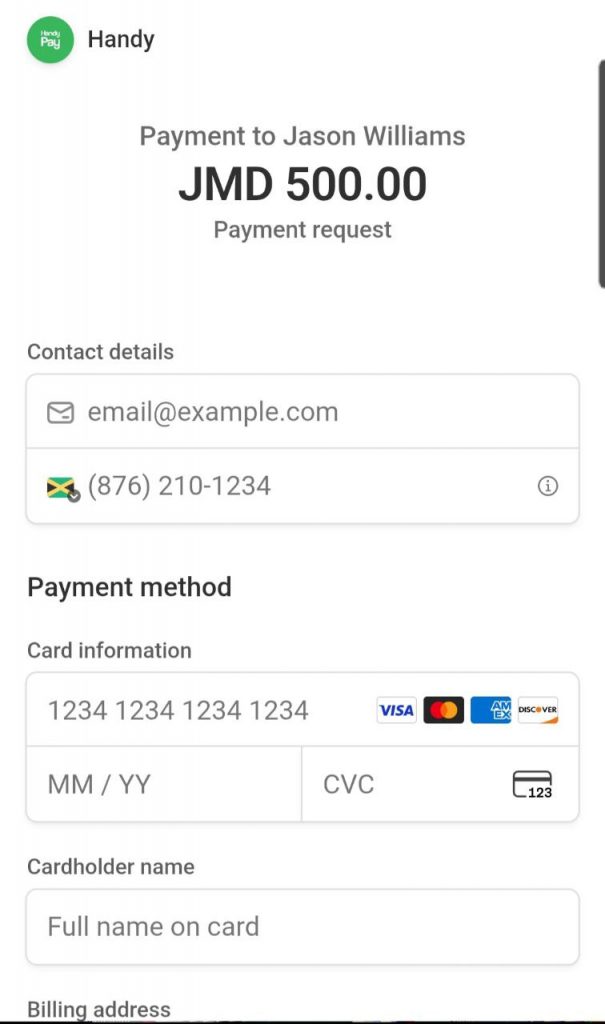

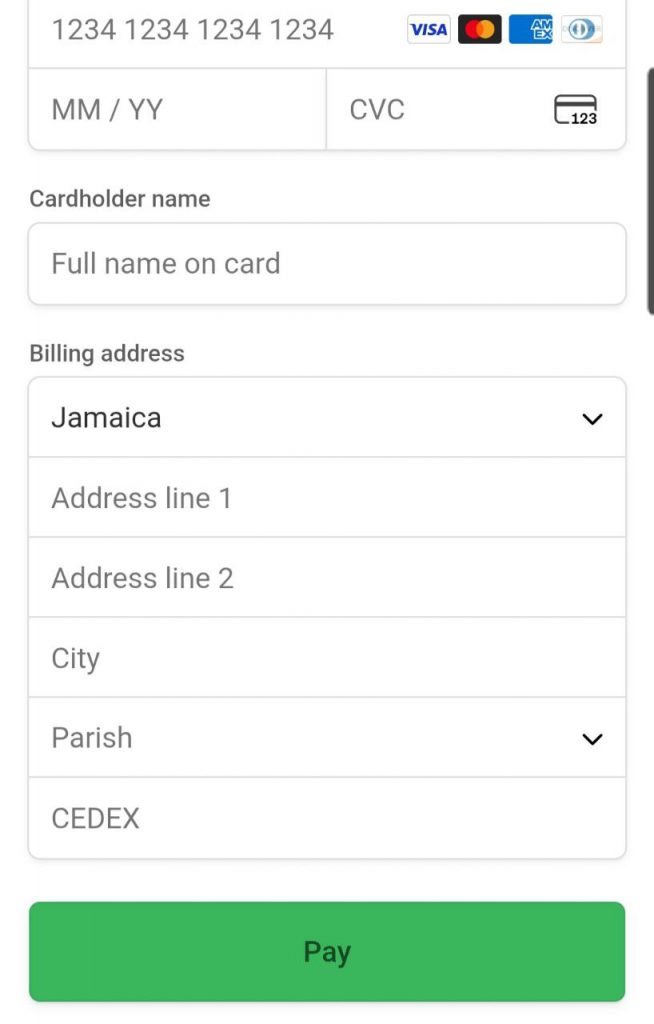

Step 4: Send the link to your customer. This link will carry them to a HandyPay Payment page. Card will be selected by default; they have to enter their details.

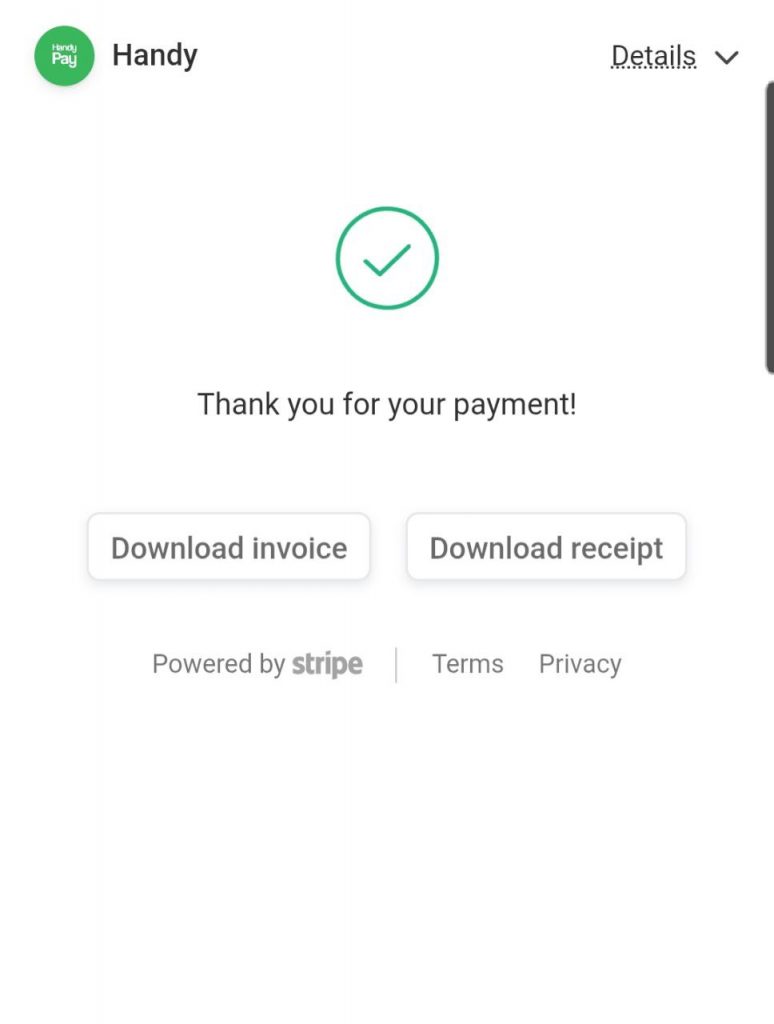

Once they select Pay, the button will display ‘processing’. After a successful payment, customers can download their receipt or invoice.

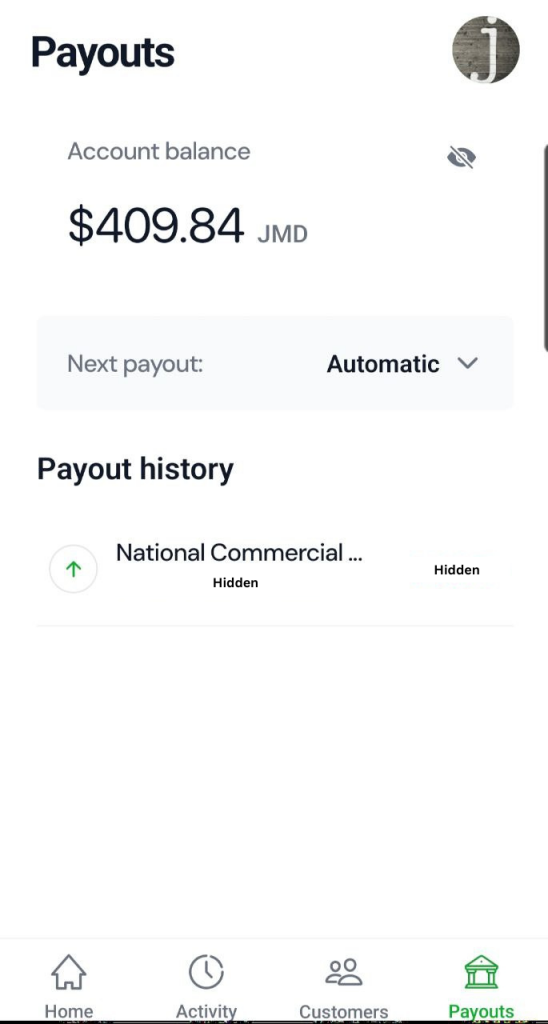

Step 5: Payment Received. Congratulations, you just accepted your first payment with HandyPay! You will receive an email with payment details.

The Payouts section of the app will be updated. Remember, it will take about 2-3 business days to receive the payment.

Interview with the Founder

I interviewed Kyle Campbell, the founder of HandyPay, to get some insights about the app. The interview follows a question and format. I decided to write out my questions, then have the full audio clips played.

Jason: What was your Inspiration for HandyPay, and how did you come up with the name?

Jason: How can I accept payments via HandyPay? Is it QR Code only?

ADVERTISEMENT

Jason: What if I don’t have a bank account? How can I accept payments?

Jason: How secure is Handy, and which payment processor is being used?

Jason: What’s the current fee for accepting a transaction via Handy Pay? Can I absorb the cost, or does it have to be the customer?

Jason: How quickly will it take me to get paid (first time sign up)?

Jason: When the money is received in my bank account, is an additional fee charged by the bank?

Jason: Is HandyPay only available in Jamaica?

Jason: Can I use HandyPay as a payment processor on my Website?

ADVERTISEMENT

Jason: What has the response to HandyPay been like so far? Do people love it?

Jason: When will large businesses be able to use HandyPay?

Jason: What are your plans for Handy Pay? Will it become a digital wallet that I can use a card with?

Jason: Are there any plans to collect remittances via HandyPay?

Jason: How can I contact you to report issues with the app?

Jason: What do you think about Jamaica’s current payment landscape?

Jason: How do you think Jamaica will look once your app becomes the standard?

Jason: What was the hardest technical hurdle you had to overcome before processing your first dollar?

Jason: Do you think Jamaica will become a cashless society in our lifetime?

Jason: What’s one piece of advice you would give to someone who is hesitating to launch their app?

ADVERTISEMENT

Jason: You seem like a serial entrepreneur. Are there any other apps that you would like people to know about?

Note Well: Handy Hurry allows you to find reliable local ‘handymen’. You can check out Handy Hurry here.

Jason: When was this launched, and how many users do you have currently?

Jason: Is there anything additional that you would like to say to the people?

Use HandyPay Today

HandyPay addresses a critical need in Jamaica by providing a secure and accessible payment platform. This digital solution protects consumers from the physical risks associated with carrying paper money while ensuring that merchants never lose a sale due to a customer lacking exact change.

By bridging this gap, the app offers a lifeline to many vendors and entrepreneurs who have previously been locked out of the digital economy, allowing them to participate in a more modern, efficient marketplace.

I am encouraging every Jamaican to play a part in this transformation by asking your local vendors if they accept HandyPay. If they are not yet on the platform, take a moment to explain the benefits and encourage them to sign up.

Increasing our collective adoption of digital payments is about more than just convenience; it is a vital step toward fueling national business growth and improving the overall safety and security of our communities.

Kyle has a YouTube video that goes over the HandyPay onboarding process and more. You can check out that video here.

“I know that HandyPay will become a major success story”

– Jason Williams